As businesses continue to face complex challenges, the role of auditors has become increasingly vital in safeguarding the integrity, business, operations and accuracy of financial reporting. As such, auditors must keep up with the ever-changing industry trends to ensure they provide the best service possible to their clients.

In recent years, the audit landscape has seen several emerging trends shaping the profession’s future. From technological advancements to changes in regulatory requirements, these trends have significant implications for CPAs, making it crucial for them to stay current. The era of manual, analytic processes is fading, and a new generation of technology-enabled auditing is emerging. Auditors must be prepared for the challenges and opportunities that this new era presents.

As technology evolves, auditors are beginning to investigate the potential benefits of technology, such as deep analytics, ICR, AI and cloud computing. However, the pace of change is accelerating, and investors and regulators will soon expect auditors to have a comprehensive understanding of technology and its ability to enhance the audit process. In addition, clients will demand an audit experience only possible with technology-enabled audits. As a result, the traditional assumptions about auditing are being challenged and will continue to evolve.

One of the most notable trends in the audit profession is the rise of data analytics. With the increasing amount of data available, auditors are turning to data analytics tools and techniques to enhance the accuracy and efficiency of their audits. This trend is revolutionizing how audits are conducted and creating new opportunities for CPAs to add value to their clients.

As businesses face more complex risks, auditors play a critical role in identifying and managing these risks. This trend requires CPAs to develop a deeper understanding of their clients’ businesses, enabling them to provide more insightful and relevant audit services.

Auditors are also increasingly demanding to provide non-financial assurance services, such as sustainability and social responsibility reporting. As businesses seek to demonstrate their commitment to sustainability and social responsibility, CPAs are well-positioned to provide the necessary assurance services that support their client’s claims.

The emerging trends in the audit industry are creating both opportunities and challenges for CPAs. By staying current with these trends, CPAs can adapt and thrive in the rapidly changing audit landscape, ultimately providing their clients with the best possible service.

Below are the top 10 trends that are expected to transform the audit landscape,

With the right strategies, audit firms can adapt to the changing landscape and provide high-quality services to their clients. Watch this space to know in detail about these emerging trends.

.jpg)

CPA firms increasingly use data analytics and AI to improve audit quality and efficiency. Data analytics analyzes large volumes of data, identifies patterns and anomalies, and detects fraud. AI tools can also automate repetitive tasks, such as data entry and reconciliation, freeing auditors to focus on higher-level tasks, such as risk assessment and analysis. Additionally, AI can help auditors identify emerging risks and provide more accurate forecasts.

With the advancements in technology, the use of data analytics and artificial intelligence (AI) in audits has become increasingly popular. CPAs are incorporating these tools to improve audit quality and efficiency by analyzing large datasets, identifying patterns, and detecting anomalies that traditional audit methods may miss.

Data analytics tools allow CPAs to perform more comprehensive and accurate audits. At the same time, AI can automate routine tasks, such as data entry and analysis, allowing CPAs to focus on more complex issues. Furthermore, these tools can provide real-time insights and visualizations, enabling CPAs to offer more value to their clients.

According to Ryan Lazanis, CPA and founder of Future Firm Inc., the accounting and audit industry is on the brink of transformation, with the rise of Artificial Intelligence being a significant and noteworthy trend.

“The hot topic in audit for 2023 and beyond is definitely artificial intelligence. With the release of ChatGPT, there’s a lot of FOMO going on about how this type of technology can be applied to the audit profession. AI right now is scorching hot,†he said.

With the increasing frequency of cyber-attacks, auditors are being called upon to examine and assess the effectiveness of their clients’ cybersecurity measures. This involves identifying and evaluating risks related to information security, including protecting sensitive data, systems, and networks. Auditors must also assess the adequacy of their clients’ internal controls related to cybersecurity and identify any weaknesses or vulnerabilities that cybercriminals could exploit.

To effectively address this trend, CPAs must stay current with the latest developments in cybersecurity and technology, including emerging threats and vulnerabilities. They must also understand cybersecurity’s regulatory and legal requirements, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). CPAs can also benefit from working with cybersecurity experts and incorporating specialized tools and techniques, such as penetration testing and vulnerability scanning, into their audit procedures.

CPAs are witnessing a growing demand for outsourced audit support services in recent years. Several factors drive this trend, including the increasing complexity of audit work, limited staff resources, and the need for specialized skills. In response, many firms are outsourcing providers to help manage their workload and improve audit quality. Outsourcing audit support services can provide several benefits to CPAs.

For one, it can allow firms to focus on their core competencies while outsourcing non-core activities such as bookkeeping, payroll processing, and other routine tasks. This can help free up staff time and resources, which can be redirected toward more strategic activities such as business development, client relations, and talent management.

Outsourcing audit support services can also provide access to specialized expertise that may not be available in-house. For example, firms may outsource forensic accounting, IT auditing, or risk management services to experts with specific skills and knowledge in these areas. This can help ensure that audits are conducted thoroughly and accurately, improving audit quality and reducing the risk of errors or omissions.

Another emerging audit trend is the implementation of new audit standards to address evolving stakeholder demands. This trend is driven by growing concerns around environmental, social, and governance (ESG) issues and the need for greater transparency and accountability in corporate reporting.

Several new audit standards have been introduced to address these concerns, including the Sustainability Accounting Standards Board (SASB) and ESG reporting requirements. These standards guide how companies should report on their ESG performance, including their carbon footprint, social impact, and governance practices.

CPAs play a critical role in implementing these new audit standards. They must stay up-to-date on the latest regulations and requirements and develop new audit approaches to ensure compliance. This may involve working with clients to gather data, assess risk, and report on ESG performance, as well as conducting additional testing to ensure the accuracy and completeness of ESG disclosures.

Implementing new audit standards can promote greater transparency and accountability in corporate reporting, improving stakeholder trust and confidence. As such, CPAs who can effectively navigate these new standards are likely to be in high demand in the coming years.

With the rapid growth of cloud computing technology, more and more accounting firms are adopting cloud-based solutions for their audit processes. Cloud technology offers several benefits, such as enhanced data security, improved collaboration between team members, and accessibility to real-time data. Cloud-based solutions enable CPAs to perform their audit work remotely, which can help reduce costs associated with travel and in-person meetings.

Moreover, cloud-based solutions offer greater flexibility, as they can be accessed from anywhere, anytime, and on any device with an internet connection. CPAs can work from home or on the go, which can help improve work-life balance and productivity.

Additionally, cloud-based solutions can help streamline the audit process, enabling easy sharing of audit documentation and real-time communication between auditors and clients. This can reduce the time required to complete audits and improve audit quality.

As technology advances, more and more accounting firms are turning to audit automation to reduce manual work and improve audit efficiency. Audit automation involves using technology to perform repetitive, low-value audit tasks such as data collection, analysis, and report generation. This can reduce the risk of errors and allow CPAs to focus on higher-value tasks such as analysis and interpretation of audit findings.

Audit automation can be achieved through specialized audit software and tools such as data analytics, artificial intelligence, and robotic process automation. These tools can help automate the audit process from start to finish, from data collection and analysis to report generation and finalization. This can reduce the time required to complete audits and improve audit quality by providing greater accuracy and consistency in audit work.

The increased use of cloud technology and audit automation in audit processes is a positive trend for CPAs. It can help improve audit efficiency, reduce costs, and improve audit quality. However, CPAS need to ensure that they are utilizing these technologies in a way that is both secure and compliant with industry regulations.

Blockchain technology is being explored as a way to improve audit transparency and accuracy, particularly in financial reporting. Blockchain can be used to create a tamper-proof audit trail that can be used to verify financial data. This technology can help auditors identify inconsistencies and fraud more easily and increase the speed and efficiency of audits.

Blockchain technology is a distributed ledger system that records transactions securely and transparently, making it difficult to manipulate or alter records. Its use in auditing can enhance transparency and accuracy in financial reporting, improving audit quality.

By using blockchain technology, auditors can access a complete and unalterable history of financial transactions, making it easier to trace transactions and detect fraud. Moreover, the use of smart contracts in blockchain can automate various audit processes, reducing the need for manual intervention and increasing audit efficiency.

Auditors increasingly adopt dynamic audit methodologies to respond to emerging risks and challenges. Dynamic methods are flexible and can adapt to changing circumstances, such as changes in regulatory requirements or new technologies. These methodologies can help auditors avoid emerging risks and ensure that audits remain relevant and effective.

The auditing profession is constantly evolving, and as new risks and challenges emerge, CPAs must adapt their audit methodologies to remain effective. With the rise of technology and globalization, new threats such as cybersecurity, privacy, and sustainability have become more prominent, and CPAs must develop new approaches to address these risks.

Additionally, the COVID-19 pandemic has introduced new challenges, such as remote auditing and heightened fraud risks. CPAs are developing more dynamic audit methodologies that incorporate these emerging risks and challenges, utilizing a risk-based approach to tailor audit procedures to each client’s unique circumstances. This approach ensures that the audit is relevant, effective, and provides value to clients.

The concept of sustainability has gained significant traction in recent years, and it is increasingly important for businesses to demonstrate their commitment to environmental responsibility and social justice. This trend has also extended to audit practices, where auditors increasingly consider sustainability and ESG factors when planning and executing audits.

Auditors can help companies identify ESG risks and opportunities, assess the effectiveness of internal controls related to sustainability and ESG, and provide assurance on the accuracy and completeness of ESG disclosures in financial reports. In addition, auditors can work with companies to develop and implement sustainability and ESG strategies and help companies meet the growing demand for sustainability reporting.

CPAs can benefit from this trend by staying up-to-date on the latest sustainability and ESG reporting standards and guidelines, such as those published by the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD). By doing so, CPAs can enhance their audit expertise and provide value-added services to clients in sustainability and ESG.

Agile project management is a flexible and iterative approach to project management that emphasizes collaboration, continuous improvement, and rapid value delivery. This methodology has gained popularity in the software development industry, but it is also being adopted in audit practices to improve audit quality, efficiency, and flexibility. Agile audit practices involve breaking down audit tasks into smaller, more manageable pieces and working on them in short sprints.

This approach allows auditors to identify and address issues as they arise quickly, adjust the audit plan in real time based on new information, and continuously improve the audit process. Agile methodologies also emphasize collaboration and communication, which can improve the quality of audit work and reduce the risk of errors and omissions.

CPAs can benefit from this trend by learning about agile project management methodologies and how they can be applied to audit practices. By adopting agile practices, CPAs can improve the efficiency and effectiveness of audits, reduce the risk of errors and omissions, and provide better value to clients.

The emerging trends in external auditing have brought significant changes in the audit industry. Technological advancements have played an important role in transforming the traditional audit process into a more efficient and effective one. The use of data analytics, artificial intelligence, and machine learning has increased audits’ accuracy and speed. Additionally, the increasing focus on non-financial reporting and environmental, social, and governance (ESG) considerations has made the audit process more comprehensive.

To stay ahead of these emerging trends, CPAs and audit firms must invest in the right technology and training to equip their teams with the necessary skills. They must embrace change and adapt to new technologies to increase efficiency and effectiveness. Audit firms should also focus on creating a continuous learning and development culture to keep up with emerging trends.

Outsourcing audit support services can be valuable for CPA firms looking to stay ahead of emerging trends. Offshoring provides access to specialized skills and expertise that may not be available in-house. It also frees up resources and enables audit firms to focus on core activities such as strategic planning, client management, and business development.

Staying ahead of emerging audit trends requires a proactive approach, including investment in technology and training, creating a continuous learning and development culture, and outsourcing where necessary. With the right strategies, audit firms can adapt to the changing landscape and provide high-quality services to their clients.

Regulatory landscapes are shifting faster than ever - and 2025 marks a defining moment. With the Reserve Bank of India consolidating 244 Master Directions and withdrawing more than 9,400 circulars, compliance is no longer just a regulatory checkbox — it's now a strategic expectation. The message is clear: Compliance must be timely, accurate, and continuously enforced.

NCS'ites Speaks

At NCS, impactful learning sessions are fueling a new wave of professional growth and bold thinking across teams. Covering essential topics such as Banking & Fundamentals, Innovation, Creativity, and Project Management, these sessions are designed to inspire associates to think bigger, act smarter, and continuously upskill in a dynamic business environment.

NCS'ites Speaks

The Year of the Snake (2025 in the Chinese zodiac) is expected to bring volatility and opportunity. Analysts note that the snake symbolizes wisdom, creativity and flexibility – traits needed as global markets recalibrate. Key drivers will include shifting U.S. policies, renewed tariffs and China's fiscal stimulus. Deutsche Bank researchers predict a mix of "plenty of opportunities, but also fatter tails", with Asia sensitive to U.S. tariff dynamics and China's support measures.

NCS'ites Speaks

In today's hyper-connected digital landscape, cyber threats are growing in complexity and scale. As organizations strive to strengthen their cyber defences, a shift in mindset is essential—one that goes beyond firewalls and encryption. Adopting a Governance, Risk and Compliance (GRC) mindset can significantly improve cybersecurity outcomes by aligning technology with organizational strategy, processes and controls.

NCS'ites Speaks

Artificial Intelligence (AI) is revolutionizing risk assessment in auditing by automating complex tasks, enhancing accuracy, and uncovering insights that might be overlooked using traditional methods. AI-driven tools enable auditors to analyze vast amounts of data quickly, identify patterns, and prioritize risks more effectively. These technologies are empowering auditors and developers to tackle complex challenges in innovative ways. Let’s delve into how AI is reshaping audit functions and its implications for developers and auditors alike.

NCS'ites Speaks

In recent years, Artificial Intelligence (AI) has transformed industries with automation, data-driven insights, and enhanced operational efficiency. Auditing, traditionally a meticulous and manual process, is no exception. AI tools, including Machine Learning (ML) models and Large Language Models (LLMs), are enabling auditors and developers to tackle complex challenges in innovative ways. Let's delve into how these technologies are shaping audit functions and what it means for developers working in this field.

NCS'ites Speaks

In digital design, making certain parts stand out is essential for helping users move through products and reach their goals easily. However, it’s important to use these attention-grabbing elements carefully, so they don’t compete with each other or look like ads. This is where the von Restorff effect, a principle based on making things different to stand out, helps us use contrast smartly and guide users’ focus.

NCS'ites Speaks

As businesses continue to face complex challenges, the role of auditors has become increasingly vital in safeguarding the integrity, business, operations and accuracy of financial reporting. As such, auditors must keep up with the ever-changing industry trends to ensure they provide the best service possible to their clients.

NCS'ites Speaks

.jpg)

We are living in the world of things which are interconnected through internet. The onset of digitalization era has opened up a lot of opportunities for every one, especially, for business and enterprise. From Mobile banking, to online shopping, to reading news and books, everything is just one click away.

NCS'ites Speaks

.jpg)

In today interconnected business landscape, organizations increasingly rely on third-party vendors and partners to deliver products and services. While these partnerships offer numerous benefits, they also expose businesses to potential risks, including data breaches, regulatory violations, and reputational damage. Establishing a robust Third-Party Risk Management (TPRM) program is crucial to safeguarding your organization from these threats. In this blog, we’ll walk you through practical steps to create an effective TPRM program, ensuring a secure and resilient business ecosystem.

NCS'ites Speaks

Using Artificial Intelligence (AI) in Internal Audit can bring numerous benefits, enhancing the efficiency and effectiveness of the Audit process. AI technologies, such as machine learning and natural language processing, can be leveraged to perform various tasks and analyses that were traditionally conducted manually, saving time and resources while increasing accuracy. Here are some ways AI can be utilized in Internal Audit:

NCS'ites Speaks

Over the past decade, the world of industry has undergone significant changes in the field of risk management. With advancements in technology, changes in business practices, and increased global competition, effective risk management has become more critical than ever before. In this article, we will explore the evolution of the industry in the past decade in risk management and the challenges and opportunities that lie ahead. Here are some of the ways in which the landscape of risk management is changing and evolving.

NCS'ites Speaks

%20(1).webp)

The success of any organization is dependent on the strength of its risk management and internal audit processes. Together, they create a powerful foundation for success! Third-party risk management has become increasingly important as organizations outsource more of their operations to external vendors, suppliers, and service providers. These third parties can introduce a range of risks, including cybersecurity, operational, financial, legal, and reputational risks. To manage these risks effectively, organizations need to implement a robust third-party risk management (TPRM) program. In this article, we will discuss TPRM and the role of internal audit in it.

NCS'ites Speaks

Our very first customer meet happened on November 21st, 2022, in Chennai on the occasion of 15 years of NCS Soft Solutions. It was for our South customers and with lots of planning in a short span we made it a great event. The event also marked the launch of our New Product eTHIC CAAM. The event started off with a prayer in the presence of Our Guest of Honor Mr. Nabankur Sen, Chairman Mr. Subramaniam N, CEO Mr. Shanmugavel P, COO Mr. Asir Roy Dinesh, CFO Mr. Padmanabhan and all our board & advisory members, valued customers, and team members.

NCS'ites Speaks

Financial Crime Risk Management Frauds, scams, financial crime have become so common, they are used almost everyday and happening around us constantly They fill pages in newspapers globally. It is also correct to mention that digital innovation has speeded up the financial crime multiple times and also innovation in carrying out the financial crimes. People are finding new ways to swindle information and money online, which thankfully, also leads to people finding new ways to protect themselves from such online scams.

NCS'ites Speaks

Understanding Web Application Security! The growth of internet and its development increases in a daily basis

NCS'ites Speaks

Why are Trainings Backbone of any Organization? Training is one of the pillars in any organisation.

NCS'ites Speaks

We are proud to announce that NCS SoftSolutions has been honored as AI Organization of the Year at the AI Excellence Awards 2025 - a landmark achievement in our journey of innovation and impact. This recognition reflects our continued commitment to leveraging Artificial Intelligence to transform Audit, Governance, Risk & Compliance (GRC) functions across the banking and financial services ecosystem.

News & Events

The interview, featuring insights from Dr. Ravi Seshadri, Advisory Board Member at NCS SoftSolutions, focuses on four major upcoming changes set to transform the insurance sector

News & Events

We're proud to share that eTHIC CAAM of NCS SoftSolutions has won the Technoviti 2025 Award by Banking Frontiers!

News & Events

NCS Annual Meet 2025 brought together minds, milestones and memories.

News & Events

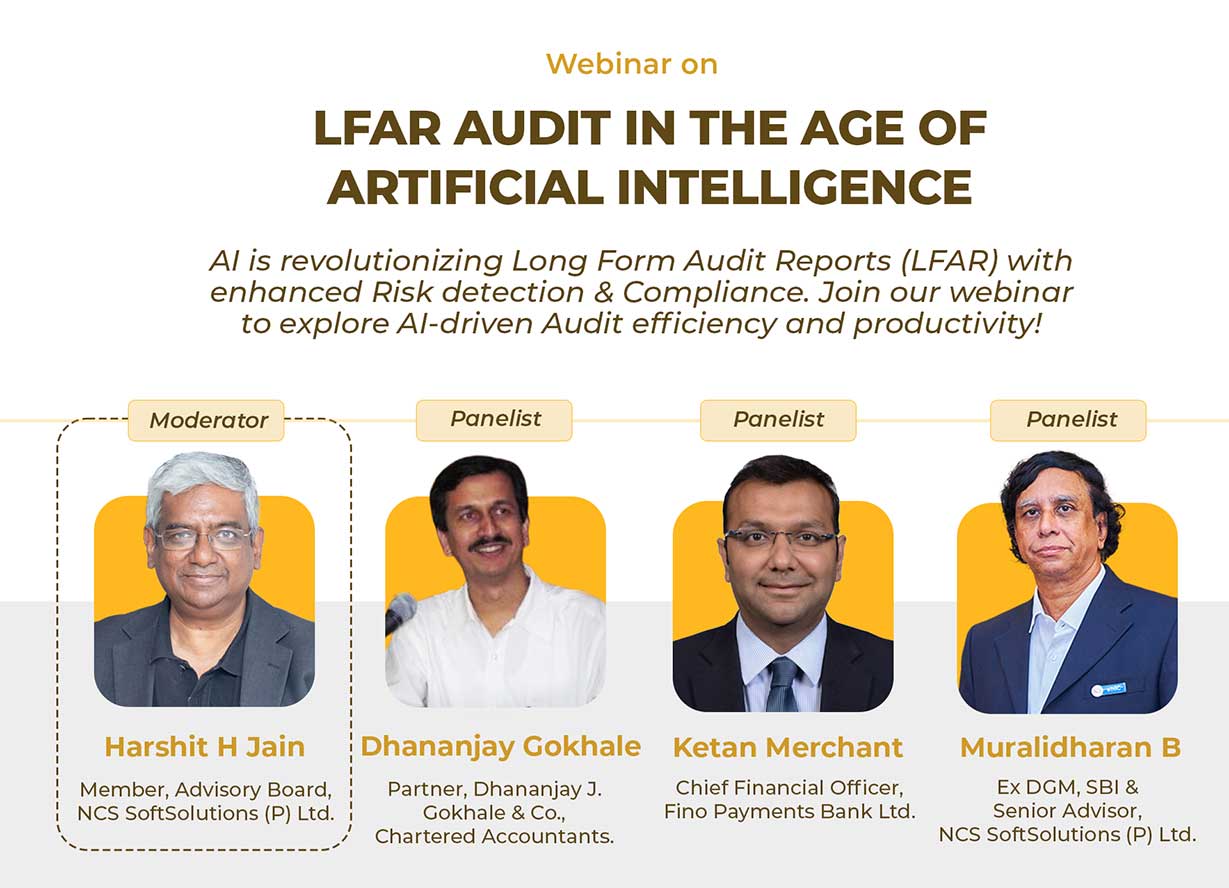

The webinar was conducted by NCS Soft Solutions on the topic of Long-Form Audit Report (LFAR) in the Age of AI. The session aimed to explore how AI can influence audit practices, particularly in Indian banks.

News & Events

We are thrilled to announce that NCS SoftSolutions has been honored with the "Most Disruptive Innovation - Best Audit Platform" award at India's Tech Pioneers 2024, presented by ET Now, Coherent Market Insights, and BrandSmith United!

News & Events

This #InternationalWomensDay, we celebrated the incredible women who inspire us every day! From a fun-filled game, creative names to a joyous cake-cutting ceremony, an hour was packed with laughter and appreciation. A special moment was hearing from the men at NCS SoftSolutions, who shared their thoughts and unwavering support for gender equality. Together, we continue to build a workplace where everyone thrives!

News & Events

At NCS SoftSolutions, we believe in acknowledging and celebrating the unique contributions of everyone in our team. This Men’s Day, we came together to honor the strength, dedication, and camaraderie of the incredible men in our office.

News & Events

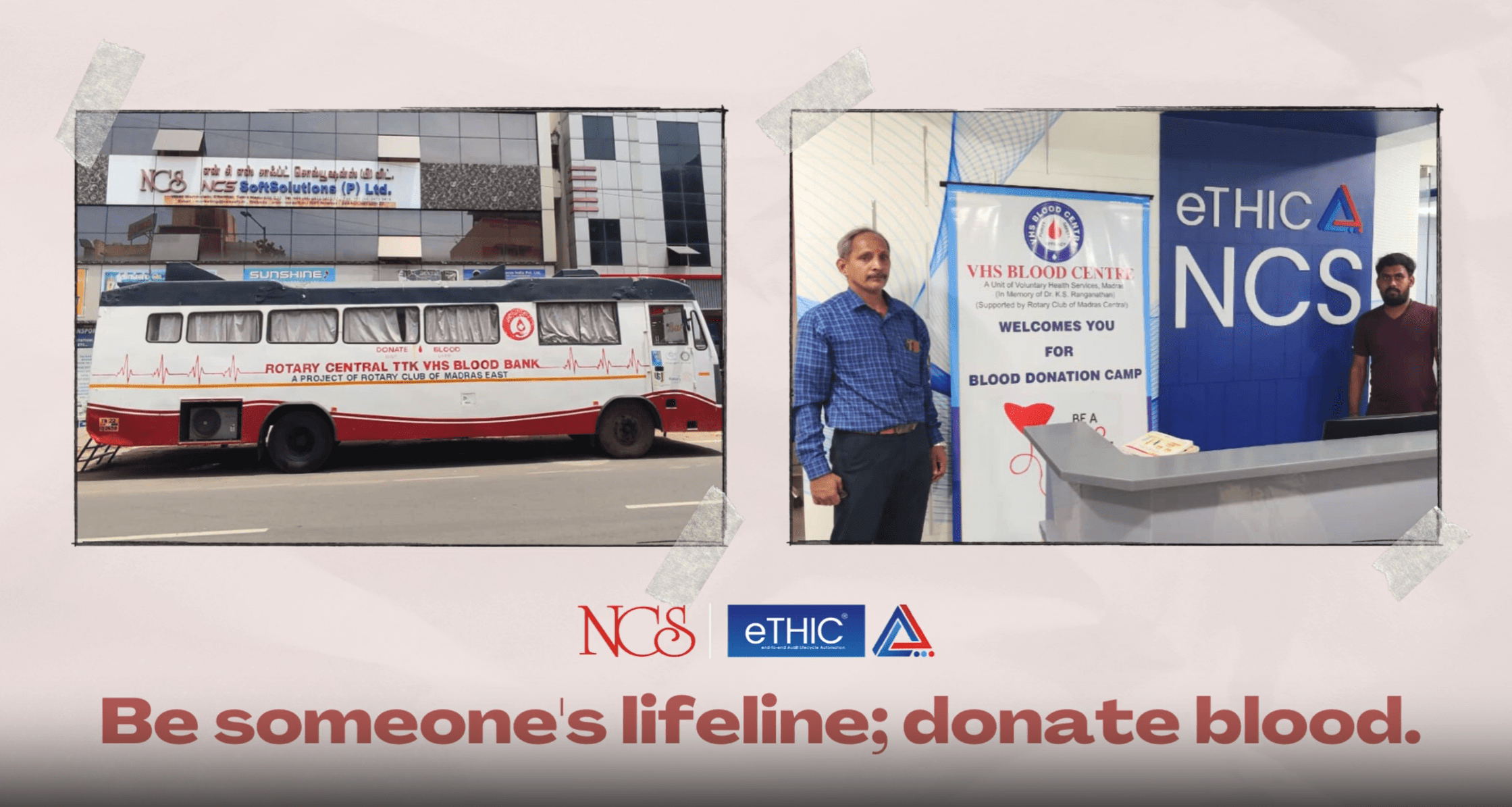

We are thrilled to receive an appreciation memento from VHS Blood Bank for our continuous support in organizing blood donation camps. At NCS SoftSolutions, we believe in giving back to the community, and this recognition inspires us to keep contributing to meaningful causes.

News & Events

We celebrated our Mumbai team's dedication with a special dinner filled with laughter, great conversations, and delicious food. Here's a glimpse of the memorable night—thank you to everyone who made it special!

News & Events

What a memorable day it was! We celebrated 17 incredible years of NCS SoftSolutions and embraced the spirit of Diwali with joy, laughter, and togetherness. From heartfelt speeches, exciting games to delightful food and gifts, the evening was filled with unforgettable moments. The energy, enthusiasm, and camaraderie of our team made it a celebration to cherish forever.

News & Events

In an esteemed recognition of industry leaders, Corporate Connect, in collaboration with Business Connect India, has acknowledged NCS SoftSolutions for its significant accomplishments and pioneering innovations in Governance, Risk, and Compliance (GRC) and audit digitisation.

News & Events

It was fantastic day of celebration! Congratulations to all those who have successfully completed their Tech MBA program, and full cheer to all teams who participated in the NCS Cricket League 2024. It has been fulfilling to witness inspiring achievements in education and exhilarating moments on the field all in one day. Here's to many more milestones and victories ahead!

News & Events

As World Blood Donors Day is on 14th June 2024, We at NCS SoftSolutions Pvt Ltd had a Blood Donation Camp today at our office premises along with VHS (The Voluntary Health Services) to raise awareness and encourage voluntary, safe and unpaid blood donations.

News & Events

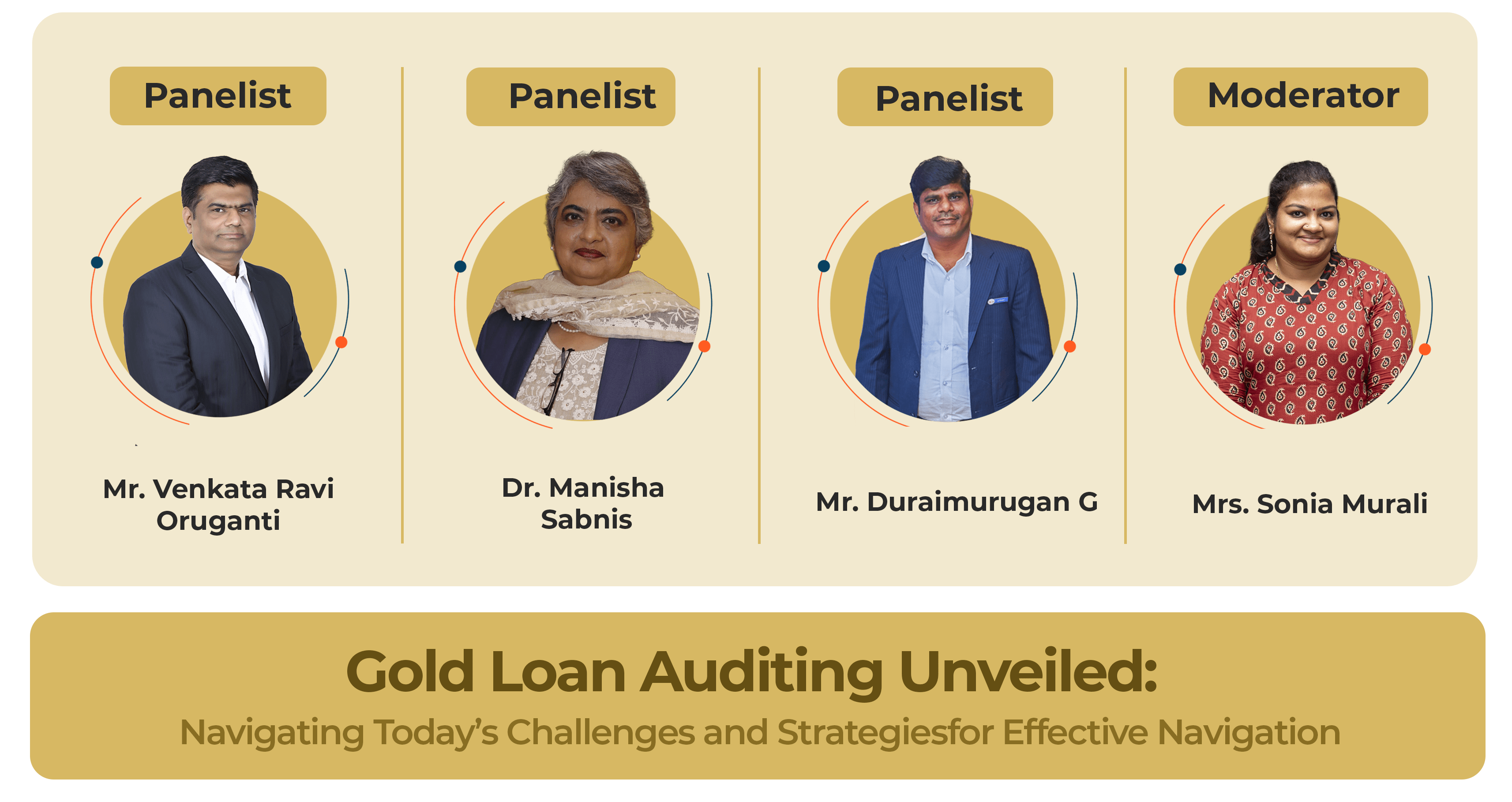

As the Head of the Digital Media team at NCS Softsolutions, I was thrilled to moderate the webinar "Gold Loan Auditing Unveiled: Navigating Today's Challenges and Strategies for Effective Navigation," which took place on June 13, 2024. We had industry experts who shared valuable insights on auditing, technology, and business management in the context of gold loans.

News & Events

We're thrilled to share that Corporate Connect's 'Impact Feature - Business Excellence Awards 2024' has honored us with the title of 'Cutting-edge AI Audit Solution - 2024'. This recognition celebrates our outstanding growth and unique contribution to the industry.

News & Events

NCS Annual Business Meet 2024-2025! Our recent business meet has been a success. Amidst a dynamic atmosphere of collaboration and innovation, our team showcased unparalleled dedication and expertise, leading to achievements. Together, we have elevated our company to new heights and set the stage for even greater accomplishments ahead.

News & Events

We're thrilled to announce the completion of our TECH MBA programme! It's been an incredible journey filled with hard work, dedication, and growth.

News & Events

On the occasion of International Women's Day, we highlight the voices of our remarkable women associates to express their journey within the organization, reflecting on the supportive work environment.

News & Events

Here is to a new beginning! As we expand our office space and aim to take the company to new heights. Thank you for your continuous support.

News & Events

We are thrilled to share that Rangamani Associates Chartered Accountants Firm has placed a groundbreaking order.

News & Events

NCS Pongal Celebration 2024. Creating wonderful memories together as we celebrated Pongal with NCS family.

News & Events

Step into the Future of Auditing and get to know how Remote Continuous Audit is Revolutionizing the Field, by NCS SoftSolutions' Webinar “The Third Eye of The Future : Remote Continuous Auditâ€.Click the below button to play full video.

News & Events

Kindly find the links below *Note: Do use Google translator to read the articles in English.

News & Events

.jpg)

We're thrilled to announce that our onsite Customer Support Team associates have successfully completed their comprehensive 'on-the-job' in-house training.

News & Events

Our Chairman Mr. Subramaniam N giving a speech on "Digitalization in Audit function in Financial Services Industry", at IAIB National Conference 2023, Indonesia.

News & Events

Successfully done with our seminar on "Governance and Audit Role in Quality Improvement of P2P Lending Industry" today (11.07.2023), along with Exlayer and AFPI, at Jakarta, Indonesia.

News & Events

For prompt filing of returns and payment of Goods and Services Tax during the financial year 2022-23, thereby substantially contributing to building a strong and resilient nation.

News & Events

Are Auditors soft targets to blame for Corporate Failures? Learn more about auditors' role in corporate governance and their potential implications. Watch Now our Webinar on Corporate Failures - Are Auditors a Soft Target to Blame? By NCS SoftSolutions as top industry experts share their insights.

News & Events

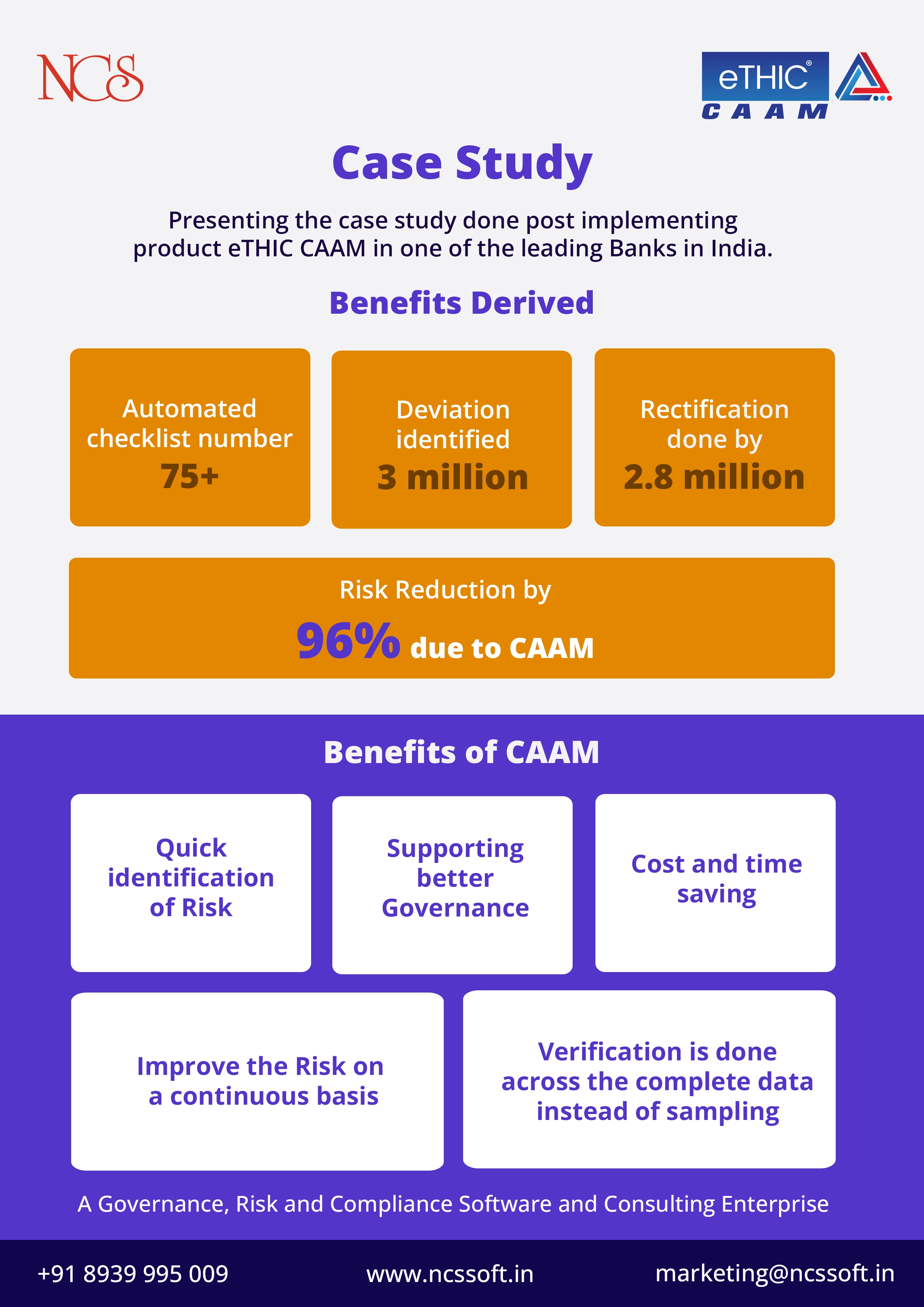

The power of collaboration and innovation can bring about remarkable changes. We are proud to have implemented eTHIC CAAM in one of India's leading banks, and the results have been inspiring!

News & Events

NCS SoftSolutions Pvt Ltd at the 6th Insurance India Summit & Awards 2023 at Westin, Goregaon, Mumbai. Visit Us to know more.

News & Events

Video Link : Business Meet 2023 - 24

News & Events

As you all know we had a fun-filled Pongal celebration with Pooja, Pongal, music, and much more. We also had a Rangoli and Pot Painting Competition. Our hearty Congratulations go to all the winners and all the participants.

News & Events

NCS as Company of the Year 2020 CIO Magazine

News & Events

Our CEO Mr. Shanmugavel's and Mr. Baskar Rao, Chief General Manager of Audit and Inspection from Union bank of India, Hyderabad, at Audit Zonal Office Meeting.

News & Events

GITEX Gulf Information Technology Exhibition, NCS exhibits eTHIC in Dubai

News & Events

Foothold into cooperative world as we work with Saraswat Bank for digitalizing their Audit Universe

News & Events

Received Audit Automation order from J K Bank

News & Events

First Breakthrough in Small Banks NCS bags order from ESAF Bank

News & Events

"The road less travelled" refers to a path or choice that is not the most common or popular one. It signifies taking a route that is unconventional and independent - often more challenging, sometimes risky, but potentially more rewarding.

Paddy's Corner

I've intentionally kept the topic short-so you can think more deeply and apply it in your own life.

Paddy's Corner

"If you fail to plan, you are planning to fail!" Benjamin Franklin. Planning isn't just about crafting the perfect roadmap for a perfect future—it's about creating a plan that can withstand reality.

Paddy's Corner

The primary driving force behind most human activity is the desire to excel-whether it's to surpass others or to raise our own level of performance. This speaks to our competitive spirit and intrinsic drive for excellence, where individuals are motivated to thrive in their respective fields.

Paddy's Corner

Being on LinkedIn, we're all familiar with the term networking. In any corporate setting-whether among young freshers or seasoned professionals-you'll often be catapulted into conversations about the importance of networking.

Paddy's Corner

Charlie Munger-a highly respected investor and thinker whom I often quote-is known for his interdisciplinary approach, long-term focus on value and remarkable ability to spot and avoid common mistakes.

Paddy's Corner

Arigato, Sanket, for your suggestion-it encouraged me to delve deeper into personal leverage. Let's learn together! Leverage is the art of accomplishing more, allowing you to achieve the same result with less time and effort.

Paddy's Corner

The phrase "γνῶθι σεαυτόν" (Gnothi seauton)-meaning "Know thyself"-is believed to have been inscribed on the Temple of Apollo at Delphi in ancient Greece. It is considered one of the most important maxims, emphasizing self-knowledge as the foundation of wisdom and a fulfilling life.

Paddy's Corner

Journaling has been a profound tool for self-expression and reflection for centuries. Whether used for personal growth, creative expression, or simply capturing life's moments, journaling offers something valuable for everyone. Journal what you love, what you hate, what's in your head, what's important.

Paddy's Corner

The Oxford English Dictionary defines intuition as the immediate apprehension of an object by the mind without the intervention of any reasoning process.

Paddy's Corner

Hedging, by definition, is a risk management strategy where investors buy or sell assets to reduce the risk of loss.

Paddy's Corner

Gratitude is something I practice every moment and fittingly, my very first LinkedIn post last year was on this very topic.

Paddy's Corner

Emotions play a significant role in investment decisions, just as they do in any business decision. Many experts advise removing emotions from investing, but let's be honest—that's not entirely possible. Emotion and investing go hand in hand. After all, our emotions often drive us to save and invest—whether it's love for our families, a need for security, or hopes for a better future.

Paddy's Corner

You're well aware of the current situation in the Indian stock markets—investors are understandably worried as their past gains have been wiped out in a matter of days. However, despite this volatility, we must not lose sight of a fundamental truth: market fluctuations are inherent and inevitable.

Paddy's Corner

Let's explore the concept of delayed gratification and why those who master this quality are more likely to succeed

Paddy's Corner

As you navigate your investment journey, you will inevitably face the choice between cash and credit cards. Should you stick to the tried-and-true method of cash, ensuring financial security, or leverage credit to maximize investment opportunities? The key takeaway is that you don't have to choose one over the other. The most important aspect of financial management is understanding both the risks and benefits of each and using them to your advantage.

Paddy's Corner

Some of my friends might josh around, asking, "Come on Paddy, again Budget? You've been preaching about budgets throughout your career."

Paddy's Corner

Aspiration is the driving force that propels us toward our goals. We have aspirations at every stage of our lives, and this post is about my personal journey with aspirations.

Paddy's Corner

We're reaching the end of my current series, and in these 19 weeks, I've shared many long articles. Now, I'd like to capture the essence of these writings with a two-part recap of the key takeaways, to reflect on this journey.

Paddy's Corner

In continuation of last week's analysis of the current popular read The Psychology of Money by Morgan Housel, here are additional key takeaways that provide valuable insights

Paddy's Corner

This week, I'll be discussing a book that's been trending among many of my younger colleagues, especially after it was highly recommended by actor Arvind Swamy in an interview.

Paddy's Corner

For this week, I'd like to discuss a book that's a cornerstone for anyone beginning their self-help journey: Rich Dad Poor Dad. This book, popular since its publication in the late 90s, truly sets a solid foundation for financial understanding. I first read it in the early 2000s, and although I didn't fully grasp its potential back then, upon reflection, I see how insightful and ahead of its time it was. I strongly encourage everyone to give it a read.

Paddy's Corner

To conclude my corporate journey, I am going to discuss two leaders whom I admire the most.

Paddy's Corner

Today I am going to discuss how an entire Team led by a Great Leader had helped an Associate to reclaim life and move forward.

Paddy's Corner

Continuing my Learnings from the Corporate Journey. Today, I want to recount an incident that highlights the importance of grit and timely action from a leader.

Paddy's Corner

Continuing with my learnings from the corporate journey, I want to touch on two important aspects.

Paddy's Corner

A quote that has driven me through various stages of my life is, "Reading is a journey of discovery."

Paddy's Corner

Typically, I start by highlighting the topic before sharing my thoughts, but this time, I decided to switch things up. After all, I believe in practicing what I preach about not succumbing to the quicksand called monotony

Paddy's Corner

Recently, I have seen many posts on my feed about young students successfully qualifying for their final examinations, and their next goal is to secure a position in a good company. In light of these events, I wish to share the journey of my career as well.

Paddy's Corner

These past few weeks, I've shared my investment journey, but my educational background is a crucial part of my life that I want to highlight. "Resilience" is the principle that has guided me through this journey.

Paddy's Corner

My journey is one of continuous learning. Although I have an interest in learning all aspects available, I have come to understand the necessity of aligning my curiosity with my goals. This endeavor has taught me the importance of Focused Curiosity.

Paddy's Corner

Continuing with our theme-based posts, this week I wanted to shed light on a habit emphasized as fundamental in the investment world: “Curiosity”

Paddy's Corner

"The power of compounding". Einstein called it the eighth wonder of the world. The Sage of Omaha, Warren Buffett, practices it. His student, the founder of Pabrai Investment Funds and Dakshana Foundation, Mohnish Pabrai, preaches it.

Paddy's Corner

My journey with this newfound thought began six years ago when I was striving to find my purpose in life. I used every resource available, whether by reading hundreds of books from libraries and stores, starting a Gratitude Journal, practicing affirmations, etc.

Paddy's Corner

Driven by curiosity and a desire to continually learn, Mr. Padmanabhan Raman (Paddy) - CFO - NCS SoftSolutions (P) Ltd, embarked on a journey of knowledge. With the mentorship of Mr. Sanket Pai, he began writing blogs, sharing the wealth of information he acquired through extensive reading. Paddy, will now be sharing his valuable insights through a weekly blog series, starting today. We hope you enjoy these articles and gain meaningful life lessons from them. Happy reading!

Paddy's Corner