The Year of the Snake (2025 in the Chinese zodiac) is expected to bring volatility and opportunity. Analysts note that the snake symbolizes wisdom, creativity and flexibility - traits needed as global markets recalibrate. Key drivers will include shifting U.S. policies, renewed tariffs and China's fiscal stimulus. Deutsche Bank researchers predict a mix of "plenty of opportunities, but also fatter tails", with Asia sensitive to U.S. tariff dynamics and China's support measures. Among these trends, rising trade friction looms large. For example, new duties on U.S.-China trade have topped 100% on many goods, upending supply chains and fueling fears of slower growth. As Sino-U.S. talks resume in mid-2025, markets watch for de-escalation. New trade corridors are also emerging (e.g. Middle East - Asia routes), driving demand for cross-border digital finance solutions.

Escalating trade wars are already impacting Asia's outlook. U.S. trade actions in 2025 (tariffs on Chinese and other imports) have disrupted supply lines and contributed to weaker forecasts for China. China's central bank has responded with targeted liquidity support to counteract tariff shocks. Across Asia, markets like India and Malaysia (with strong domestic demand and high rates) may outperform export-dependent economies in this environment.

Amid these shifts, banks and fintech firms must stay nimble. Digital finance strategies are being stress-tested by market uncertainty, forcing incumbents to cut costs and accelerate innovation. For instance, 55% of banks worldwide now legacy IT platforms as a major obstacle to modernization, highlighting the need to overhaul outdated systems.

In 2025, banks face a "digital stress test". Surging compliance demands and customer expectations are pushing institutions to automate core processes. The latest U.S. regulations (e.g. new data-sharing mandates) require real-time information access, which legacy systems struggle to provide. To thrive, banks are partnering with fintech providers, deploying Robotic Process Automation (RPA) and AI tools. Notably, Deloitte reports RPA projects can deliver 3-10x ROI in just one year.

These technologies enable 24/7 banking and near-instant services, such as rapid mortgage and loan approvals (e.g. Ant's "3-1-0" model in China: loans approved in <3 min, <1 sec to decision, with zero human intervention). As one UiPath executive put it, RPA and AI are "revolutionizing the way we work" in finance.

Asia remains a powerhouse of fintech innovation and financial inclusion. In China, Ant Financial's digital platform (Alipay) powers a "3-1-0" lending model via MYbank. This means collateral-free loans can be applied for in under 3 minutes, approved in <1 second, with no human sign-off - dramatically cutting costs and expanding SME credit.

In South Asia, Bangladesh's bKash illustrates scale and social impact. Launched in 2011, bKash became Bangladesh's first "unicorn" fintech. By 2017 it had 30 million account holders. It leveraged partnerships (with telcos, Ant Group, Huawei) to move users from USSD-based mobile money to app-driven services. A 2020 study credited bKash with empowering women, raising household incomes, improving financial transparency and inclusion in Bangladesh.

Remarkably, the government declared bKash an "essential service" during COVID-19 lockdowns, ensuring citizens could send/receive money safely. Other fintech examples highlight diversity: India's Paytm (early mobile wallet pioneer) still processes over a billion UPI transactions, but its market share has fallen under intense competition. In mid-2024, Paytm's UPI share dipped to 8.1% (about 1.1B monthly transactions), trailing behind PhonePe and Google Pay. Meanwhile, China's super-app WeChat Pay boasts ~935 million users as of 2023. Its growth (adding 15M users over 2022) underscores that even domestic markets are not saturated. Looking outward, China's Belt & Road Initiative (BRI) is exporting fintech capabilities to partner nations. For example, the Bank of China has launched cross-border "Belt and Road FinTech" projects (in collaboration with institutions like the World Bank) to improve payments and credit in emerging markets. Hong Kong fintechs are also active: WeLab (digital lender and bank) now serves over 70 million people across Hong Kong, China and Indonesia, strengthening Asia's digital finance network.

Sri Lanka, recovering from a recent economic crisis, is racing to digitize its financial sector. The 2025 budget earmarked US$10 million for a National Digital Economy Strategy, aiming to add $15?billion via digital services in five years.

A cornerstone is a national digital ID (SL-UDI),intended to eliminate duplicate identities and improve data accuracy across government and banks. New legislation is also being crafted to facilitate digital payments and strengthen cybersecurity and data privacy.

Sri Lankan banks have embraced a hybrid work model post-pandemic - blending remote and in-branch operations - to maintain service during volatility. Globally, 68% of companies plan to keep hybrid workplaces for flexibility and resilience. In Sri Lanka, this approach has helped banks sustain customer service during cash shortages and currency fluctuations. Building digital trust is a priority. Recent research highlights that Sri Lankan banking's digital resilience depends on robust cybersecurity and customer trust. As one review notes, a holistic strategy - balancing innovation (AI, blockchain) with strong data protection and compliance - is essential for continuity. In practice, banks are enhancing online/mobile platforms and training staff to provide remote support. By keeping human advisory channels alongside apps , Sri Lankan banks aim to secure trust even as they digitize.

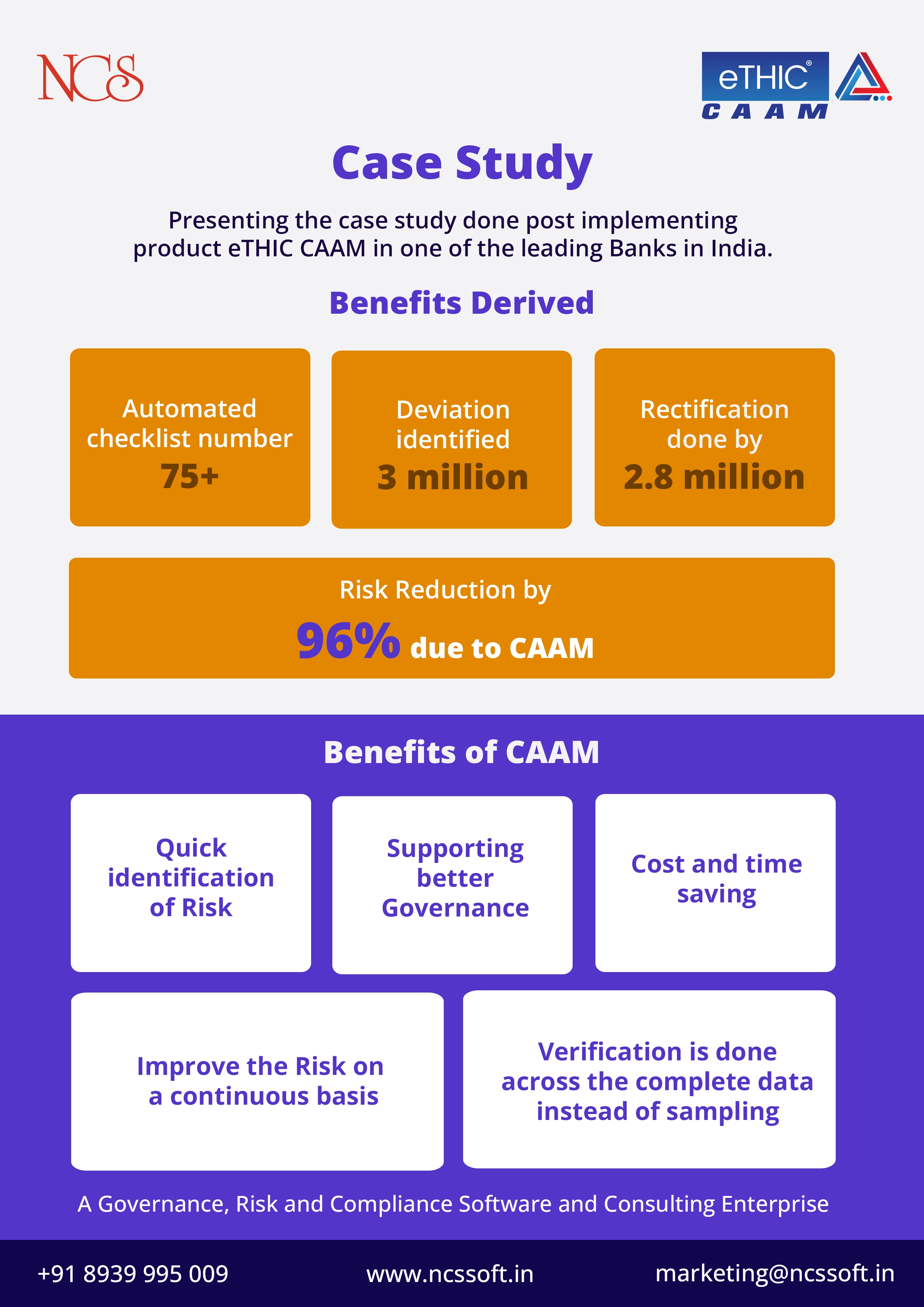

Cost Savings. Automation dramatically cuts costs. For example, one report shows RPA can reduce operational costs by 59% while boosting compliance by 92%. We see this in banking: Mexico's Banco Azteca implemented UiPath AI-bots and boosted productivity by 50%, slashing back-office workloads. Global surveys echo that RPA projects often pay back 3-10x in the first year. AI-driven audit tools (e.g. NCS SoftSolutions - eTHIC, UiPath Insights) automate controls testing and risk checks, reducing manual effort and error.

Enhanced Usability & Compliance. Digital tools streamline KYC/AML and onboarding. AI-powered AML software alone has cut compliance spending by 60% in some banks, as systems flag suspicious transactions faster and more accurately. Integrated ID verification means account opening can shrink from days to minutes. Customers get instant transparency (transaction alerts, digital statements) while institutions simultaneously meet AML and regulatory requirements. For example, automated transaction monitoring (via RPA bots) can create audit trails in real time. These improvements reduce friction: clients avoid branch queues, and banks significantly cut the error rate in compliance (EY studies report up to 90% error reduction).

Personalization & User Experience. Data analytics and AI are reshaping service quality. Many digital banks now include automated budgeting tools that analyze spending and alert customers to overspending or saving opportunities. Platforms offer personalized product recommendations based on real-time data. Fintech apps also unlock new asset classes at the user level: for instance, mobile wallets often integrate crypto trading and digital gold options, enabling any user to invest in bitcoin, ethereum or tokenized precious metals with a few taps. This hyper-personalization increases engagement: customers receive custom notifications (bill reminders, budget warnings, investment tips) that fit their profile. In essence, digital banking turns big data into individualized advice, improving satisfaction and loyalty.

Sustainable Banking & ESG. "Green finance" is shifting from niche to mainstream. Surveys show strong consumer demand: a 2022 study found 67% of global customers want their bank to be more sustainable, and 84% of those using ESG-aligned products report higher satisfaction. In the EU, regulators are also pushing transparency on "green" products; however, only 30-32% of consumers currently recognize sustainable finance options. To meet this trend, banks are embedding ESG into digital channels: examples include online platforms that let customers allocate deposits to green bonds or tag purchases by carbon footprint. Digital transparency tools (e.g. apps showing how investments support climate goals) help build trust. Regulators are mandating disclosure (e.g. EU taxonomy alignment by late 2024), so banks offer sustainable savings accounts and credit lines that finance renewable projects. By marketing these via mobile banking and gamified apps, financial institutions turn sustainability into a competitive service feature. Emerging practices include data-driven "green scoring" for portfolios and integration of ESG data into credit scoring.

Looking ahead, digital finance must evolve responsibly. The next phase will blend cutting-edge tech with ethical and inclusive principles. Financial services should ensure privacy and data rights even as AI and biometrics proliferate, avoiding "surveillance" pitfalls. Inclusivity means extending digital access to underbanked and elders, not just the tech-savvy youth.

Fintech innovations (like blockchain and AI) must be governed by fairness and transparency: for example, algorithms that set loan rates need explainability to prevent bias. Moreover, sustainable innovation is key: digital banking's growth must align with climate and social goals, from funding renewables to supporting community development.

In summary, 2025's climate of trade shocks and high rates will amplify the urgency of digital transformation in finance. Successful banks and fintechs will combine nimble technology (AI, RPA, mobile platforms) with trust-building measures (robust cybersecurity, clear communications, ESG commitments). By weaving ethics and inclusivity into innovation - and by learning from pioneers like Ant Financial, bKash and others - the sector can lead us into a next-generation financial ecosystem: one that is secure, sustainable, and tailored to the needs of all consumers and businesses.

Just In Time Group NCS SoftSolutions (P) Ltd #AI #cryptocurrency #ESG #Cybersecurity

Dilruckshan Hettiarachchi - Chief Sales Officer (CSO) - Designate - Just In Time Group - Sri Lanka.

Regulatory landscapes are shifting faster than ever - and 2025 marks a defining moment. With the Reserve Bank of India consolidating 244 Master Directions and withdrawing more than 9,400 circulars, compliance is no longer just a regulatory checkbox ā it's now a strategic expectation. The message is clear: Compliance must be timely, accurate, and continuously enforced.

NCS'ites Speaks

At NCS, impactful learning sessions are fueling a new wave of professional growth and bold thinking across teams. Covering essential topics such as Banking & Fundamentals, Innovation, Creativity, and Project Management, these sessions are designed to inspire associates to think bigger, act smarter, and continuously upskill in a dynamic business environment.

NCS'ites Speaks

The Year of the Snake (2025 in the Chinese zodiac) is expected to bring volatility and opportunity. Analysts note that the snake symbolizes wisdom, creativity and flexibility ā traits needed as global markets recalibrate. Key drivers will include shifting U.S. policies, renewed tariffs and China's fiscal stimulus. Deutsche Bank researchers predict a mix of "plenty of opportunities, but also fatter tails", with Asia sensitive to U.S. tariff dynamics and China's support measures.

NCS'ites Speaks

In today's hyper-connected digital landscape, cyber threats are growing in complexity and scale. As organizations strive to strengthen their cyber defences, a shift in mindset is essentialāone that goes beyond firewalls and encryption. Adopting a Governance, Risk and Compliance (GRC) mindset can significantly improve cybersecurity outcomes by aligning technology with organizational strategy, processes and controls.

NCS'ites Speaks

Artificial Intelligence (AI) is revolutionizing risk assessment in auditing by automating complex tasks, enhancing accuracy, and uncovering insights that might be overlooked using traditional methods. AI-driven tools enable auditors to analyze vast amounts of data quickly, identify patterns, and prioritize risks more effectively. These technologies are empowering auditors and developers to tackle complex challenges in innovative ways. Letās delve into how AI is reshaping audit functions and its implications for developers and auditors alike.

NCS'ites Speaks

In recent years, Artificial Intelligence (AI) has transformed industries with automation, data-driven insights, and enhanced operational efficiency. Auditing, traditionally a meticulous and manual process, is no exception. AI tools, including Machine Learning (ML) models and Large Language Models (LLMs), are enabling auditors and developers to tackle complex challenges in innovative ways. Let's delve into how these technologies are shaping audit functions and what it means for developers working in this field.

NCS'ites Speaks

In digital design, making certain parts stand out is essential for helping users move through products and reach their goals easily. However, itās important to use these attention-grabbing elements carefully, so they donāt compete with each other or look like ads. This is where the von Restorff effect, a principle based on making things different to stand out, helps us use contrast smartly and guide usersā focus.

NCS'ites Speaks

As businesses continue to face complex challenges, the role of auditors has become increasingly vital in safeguarding the integrity, business, operations and accuracy of financial reporting. As such, auditors must keep up with the ever-changing industry trends to ensure they provide the best service possible to their clients.

NCS'ites Speaks

.jpg)

We are living in the world of things which are interconnected through internet. The onset of digitalization era has opened up a lot of opportunities for every one, especially, for business and enterprise. From Mobile banking, to online shopping, to reading news and books, everything is just one click away.

NCS'ites Speaks

.jpg)

In today interconnected business landscape, organizations increasingly rely on third-party vendors and partners to deliver products and services. While these partnerships offer numerous benefits, they also expose businesses to potential risks, including data breaches, regulatory violations, and reputational damage. Establishing a robust Third-Party Risk Management (TPRM) program is crucial to safeguarding your organization from these threats. In this blog, weĆ¢ā¬ā¢ll walk you through practical steps to create an effective TPRM program, ensuring a secure and resilient business ecosystem.

NCS'ites Speaks

Using Artificial Intelligence (AI) in Internal Audit can bring numerous benefits, enhancing the efficiency and effectiveness of the Audit process. AI technologies, such as machine learning and natural language processing, can be leveraged to perform various tasks and analyses that were traditionally conducted manually, saving time and resources while increasing accuracy. Here are some ways AI can be utilized in Internal Audit:

NCS'ites Speaks

Over the past decade, the world of industry has undergone significant changes in the field of risk management. With advancements in technology, changes in business practices, and increased global competition, effective risk management has become more critical than ever before. In this article, we will explore the evolution of the industry in the past decade in risk management and the challenges and opportunities that lie ahead. Here are some of the ways in which the landscape of risk management is changing and evolving.

NCS'ites Speaks

%20(1).webp)

The success of any organization is dependent on the strength of its risk management and internal audit processes. Together, they create a powerful foundation for success! Third-party risk management has become increasingly important as organizations outsource more of their operations to external vendors, suppliers, and service providers. These third parties can introduce a range of risks, including cybersecurity, operational, financial, legal, and reputational risks. To manage these risks effectively, organizations need to implement a robust third-party risk management (TPRM) program. In this article, we will discuss TPRM and the role of internal audit in it.

NCS'ites Speaks

Our very first customer meet happened on November 21st, 2022, in Chennai on the occasion of 15 years of NCS Soft Solutions. It was for our South customers and with lots of planning in a short span we made it a great event. The event also marked the launch of our New Product eTHIC CAAM. The event started off with a prayer in the presence of Our Guest of Honor Mr. Nabankur Sen, Chairman Mr. Subramaniam N, CEO Mr. Shanmugavel P, COO Mr. Asir Roy Dinesh, CFO Mr. Padmanabhan and all our board & advisory members, valued customers, and team members.

NCS'ites Speaks

Financial Crime Risk Management Frauds, scams, financial crime have become so common, they are used almost everyday and happening around us constantly They fill pages in newspapers globally. It is also correct to mention that digital innovation has speeded up the financial crime multiple times and also innovation in carrying out the financial crimes. People are finding new ways to swindle information and money online, which thankfully, also leads to people finding new ways to protect themselves from such online scams.

NCS'ites Speaks

Understanding Web Application Security! The growth of internet and its development increases in a daily basis

NCS'ites Speaks

Why are Trainings Backbone of any Organization? Training is one of the pillars in any organisation.

NCS'ites Speaks

We are proud to announce that NCS SoftSolutions has been honored as AI Organization of the Year at the AI Excellence Awards 2025 - a landmark achievement in our journey of innovation and impact. This recognition reflects our continued commitment to leveraging Artificial Intelligence to transform Audit, Governance, Risk & Compliance (GRC) functions across the banking and financial services ecosystem.

News & Events

The interview, featuring insights from Dr. Ravi Seshadri, Advisory Board Member at NCS SoftSolutions, focuses on four major upcoming changes set to transform the insurance sector

News & Events

We're proud to share that eTHIC CAAM of NCS SoftSolutions has won the Technoviti 2025 Award by Banking Frontiers!

News & Events

NCS Annual Meet 2025 brought together minds, milestones and memories.

News & Events

The webinar was conducted by NCS Soft Solutions on the topic of Long-Form Audit Report (LFAR) in the Age of AI. The session aimed to explore how AI can influence audit practices, particularly in Indian banks.

News & Events

We are thrilled to announce that NCS SoftSolutions has been honored with the "Most Disruptive Innovation - Best Audit Platform" award at India's Tech Pioneers 2024, presented by ET Now, Coherent Market Insights, and BrandSmith United!

News & Events

This #InternationalWomensDay, we celebrated the incredible women who inspire us every day! From a fun-filled game, creative names to a joyous cake-cutting ceremony, an hour was packed with laughter and appreciation. A special moment was hearing from the men at NCS SoftSolutions, who shared their thoughts and unwavering support for gender equality. Together, we continue to build a workplace where everyone thrives!

News & Events

At NCS SoftSolutions, we believe in acknowledging and celebrating the unique contributions of everyone in our team. This Menās Day, we came together to honor the strength, dedication, and camaraderie of the incredible men in our office.

News & Events

We are thrilled to receive an appreciation memento from VHS Blood Bank for our continuous support in organizing blood donation camps. At NCS SoftSolutions, we believe in giving back to the community, and this recognition inspires us to keep contributing to meaningful causes.

News & Events

We celebrated our Mumbai team's dedication with a special dinner filled with laughter, great conversations, and delicious food. Here's a glimpse of the memorable nightāthank you to everyone who made it special!

News & Events

What a memorable day it was! We celebrated 17 incredible years of NCS SoftSolutions and embraced the spirit of Diwali with joy, laughter, and togetherness. From heartfelt speeches, exciting games to delightful food and gifts, the evening was filled with unforgettable moments. The energy, enthusiasm, and camaraderie of our team made it a celebration to cherish forever.

News & Events

In an esteemed recognition of industry leaders, Corporate Connect, in collaboration with Business Connect India, has acknowledged NCS SoftSolutions for its significant accomplishments and pioneering innovations in Governance, Risk, and Compliance (GRC) and audit digitisation.

News & Events

It was fantastic day of celebration! Congratulations to all those who have successfully completed their Tech MBA program, and full cheer to all teams who participated in the NCS Cricket League 2024. It has been fulfilling to witness inspiring achievements in education and exhilarating moments on the field all in one day. Here's to many more milestones and victories ahead!

News & Events

As World Blood Donors Day is on 14th June 2024, We at NCS SoftSolutions Pvt Ltd had a Blood Donation Camp today at our office premises along with VHS (The Voluntary Health Services) to raise awareness and encourage voluntary, safe and unpaid blood donations.

News & Events

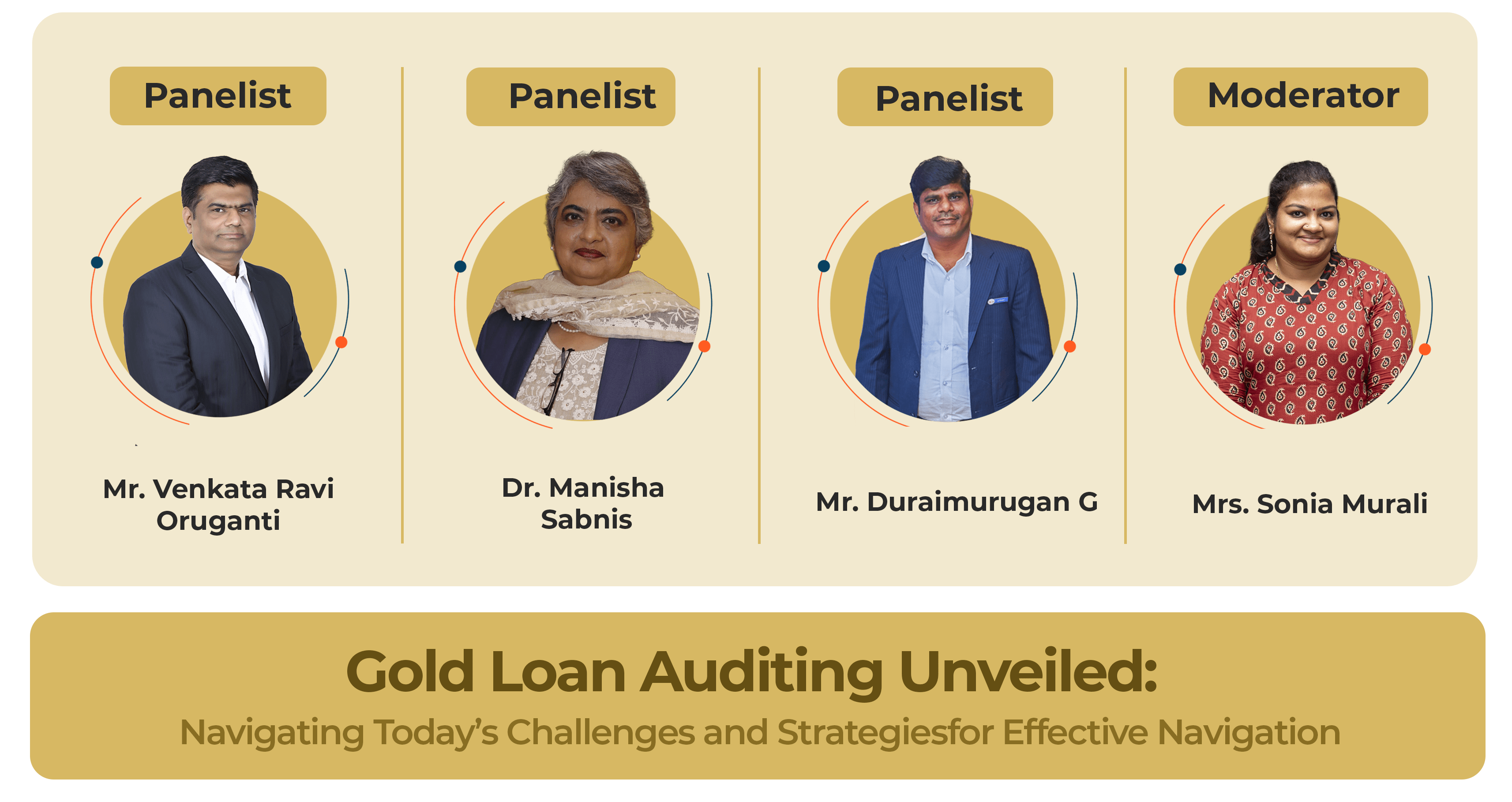

As the Head of the Digital Media team at NCS Softsolutions, I was thrilled to moderate the webinar "Gold Loan Auditing Unveiled: Navigating Today's Challenges and Strategies for Effective Navigation," which took place on June 13, 2024. We had industry experts who shared valuable insights on auditing, technology, and business management in the context of gold loans.

News & Events

We're thrilled to share that Corporate Connect's 'Impact Feature - Business Excellence Awards 2024' has honored us with the title of 'Cutting-edge AI Audit Solution - 2024'. This recognition celebrates our outstanding growth and unique contribution to the industry.

News & Events

NCS Annual Business Meet 2024-2025! Our recent business meet has been a success. Amidst a dynamic atmosphere of collaboration and innovation, our team showcased unparalleled dedication and expertise, leading to achievements. Together, we have elevated our company to new heights and set the stage for even greater accomplishments ahead.

News & Events

We're thrilled to announce the completion of our TECH MBA programme! It's been an incredible journey filled with hard work, dedication, and growth.

News & Events

On the occasion of International Women's Day, we highlight the voices of our remarkable women associates to express their journey within the organization, reflecting on the supportive work environment.

News & Events

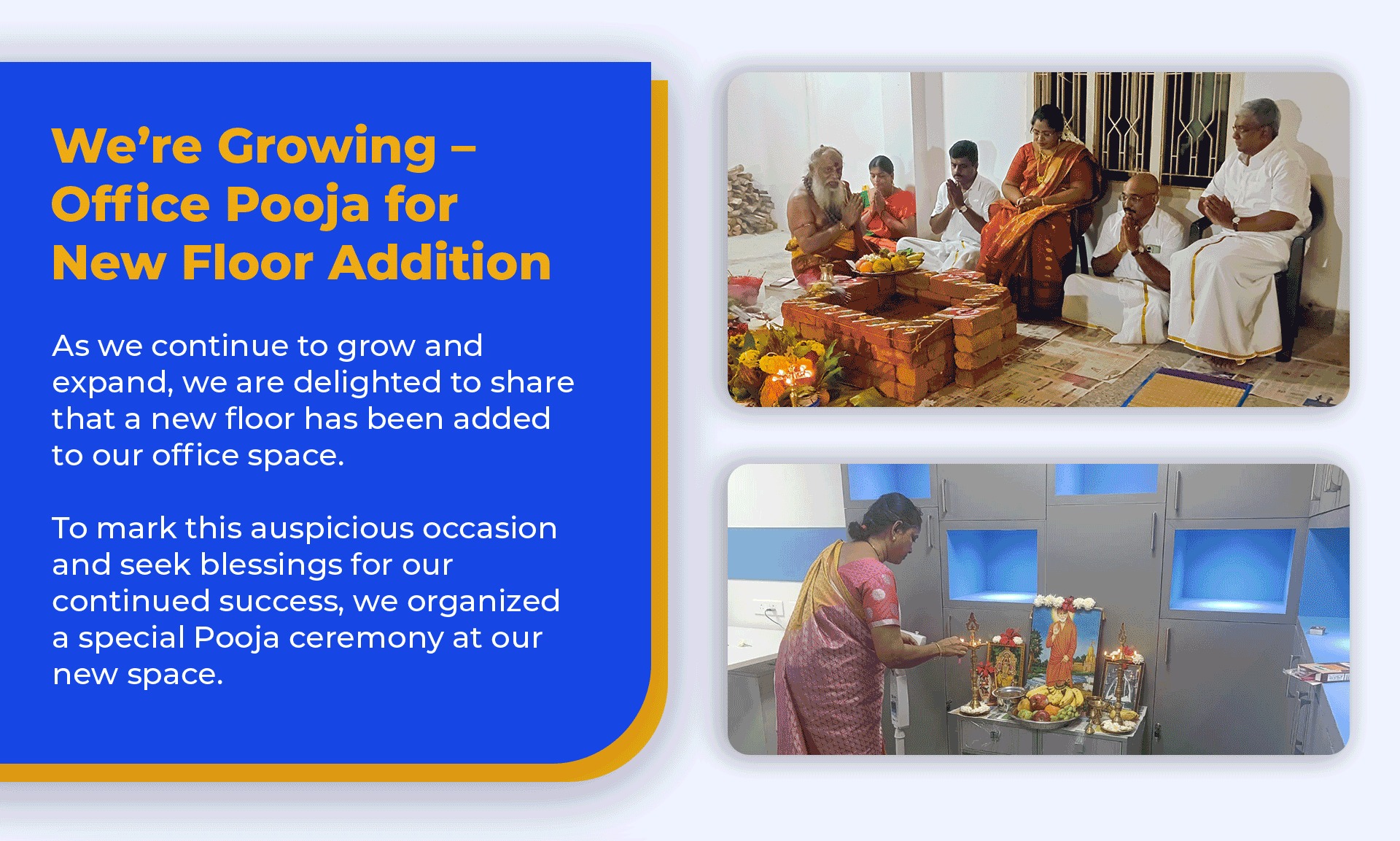

Here is to a new beginning! As we expand our office space and aim to take the company to new heights. Thank you for your continuous support.

News & Events

We are thrilled to share that Rangamani Associates Chartered Accountants Firm has placed a groundbreaking order.

News & Events

NCS Pongal Celebration 2024. Creating wonderful memories together as we celebrated Pongal with NCS family.

News & Events

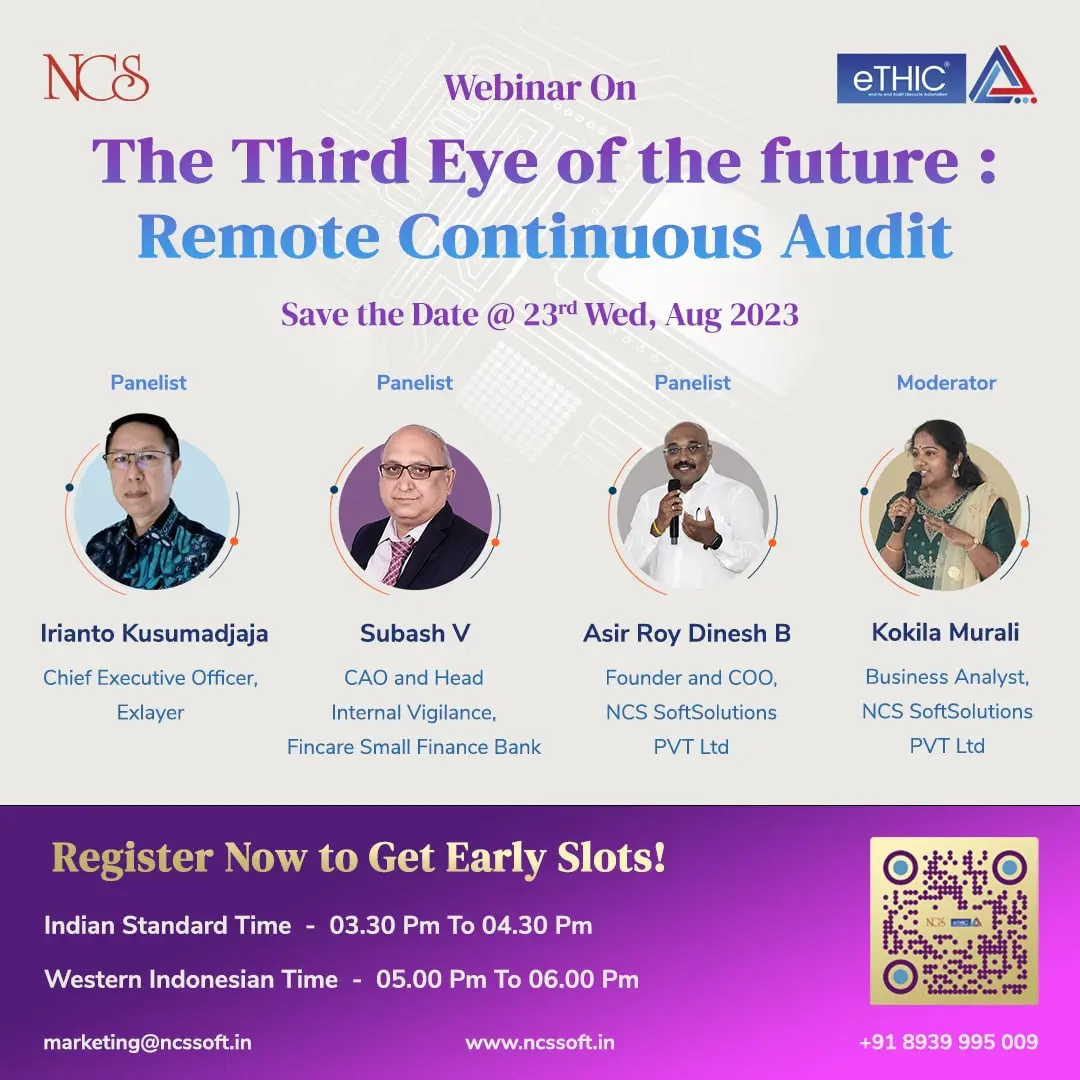

Step into the Future of Auditing and get to know how Remote Continuous Audit is Revolutionizing the Field, by NCS SoftSolutions' Webinar Ć¢ā¬ÅThe Third Eye of The Future : Remote Continuous AuditĆ¢ā¬Ā.Click the below button to play full video.

News & Events

Kindly find the links below *Note: Do use Google translator to read the articles in English.

News & Events

.jpg)

We're thrilled to announce that our onsite Customer Support Team associates have successfully completed their comprehensive 'on-the-job' in-house training.

News & Events

Our Chairman Mr. Subramaniam N giving a speech on "Digitalization in Audit function in Financial Services Industry", at IAIB National Conference 2023, Indonesia.

News & Events

Successfully done with our seminar on "Governance and Audit Role in Quality Improvement of P2P Lending Industry" today (11.07.2023), along with Exlayer and AFPI, at Jakarta, Indonesia.

News & Events

For prompt filing of returns and payment of Goods and Services Tax during the financial year 2022-23, thereby substantially contributing to building a strong and resilient nation.

News & Events

Are Auditors soft targets to blame for Corporate Failures? Learn more about auditors' role in corporate governance and their potential implications. Watch Now our Webinar on Corporate Failures - Are Auditors a Soft Target to Blame? By NCS SoftSolutions as top industry experts share their insights.

News & Events

The power of collaboration and innovation can bring about remarkable changes. We are proud to have implemented eTHIC CAAM in one of India's leading banks, and the results have been inspiring!

News & Events

NCS SoftSolutions Pvt Ltd at the 6th Insurance India Summit & Awards 2023 at Westin, Goregaon, Mumbai. Visit Us to know more.

News & Events

Video Link : Business Meet 2023 - 24

News & Events

As you all know we had a fun-filled Pongal celebration with Pooja, Pongal, music, and much more. We also had a Rangoli and Pot Painting Competition. Our hearty Congratulations go to all the winners and all the participants.

News & Events

NCS as Company of the Year 2020 CIO Magazine

News & Events

Our CEO Mr. Shanmugavel's and Mr. Baskar Rao, Chief General Manager of Audit and Inspection from Union bank of India, Hyderabad, at Audit Zonal Office Meeting.

News & Events

GITEX Gulf Information Technology Exhibition, NCS exhibits eTHIC in Dubai

News & Events

Foothold into cooperative world as we work with Saraswat Bank for digitalizing their Audit Universe

News & Events

Received Audit Automation order from J K Bank

News & Events

First Breakthrough in Small Banks NCS bags order from ESAF Bank

News & Events

Let's start with SIP ā Systematic Investment Plan. SIP is a powerful tool for wealth creation. It encourages disciplined savings, enables small, regular investments and helps navigate market volatility.

Paddy's Corner

Let's start with SIP ā Systematic Investment Plan. SIP is a powerful tool for wealth creation. It encourages disciplined savings, enables small, regular investments and helps navigate market volatility.

Paddy's Corner

I've intentionally kept the topic short-so you can think more deeply and apply it in your own life.

Paddy's Corner

"If you fail to plan, you are planning to fail!" Benjamin Franklin. Planning isn't just about crafting the perfect roadmap for a perfect futureāit's about creating a plan that can withstand reality.

Paddy's Corner

The primary driving force behind most human activity is the desire to excel-whether it's to surpass others or to raise our own level of performance. This speaks to our competitive spirit and intrinsic drive for excellence, where individuals are motivated to thrive in their respective fields.

Paddy's Corner

Being on LinkedIn, we're all familiar with the term networking. In any corporate setting-whether among young freshers or seasoned professionals-you'll often be catapulted into conversations about the importance of networking.

Paddy's Corner

Charlie Munger-a highly respected investor and thinker whom I often quote-is known for his interdisciplinary approach, long-term focus on value and remarkable ability to spot and avoid common mistakes.

Paddy's Corner

Arigato, Sanket, for your suggestion-it encouraged me to delve deeper into personal leverage. Let's learn together! Leverage is the art of accomplishing more, allowing you to achieve the same result with less time and effort.

Paddy's Corner

The phrase "Ī³Ī½įæ¶ĪøĪ¹ ĻĪµĪ±Ļ ĻĻĪ½" (Gnothi seauton)-meaning "Know thyself"-is believed to have been inscribed on the Temple of Apollo at Delphi in ancient Greece. It is considered one of the most important maxims, emphasizing self-knowledge as the foundation of wisdom and a fulfilling life.

Paddy's Corner

Journaling has been a profound tool for self-expression and reflection for centuries. Whether used for personal growth, creative expression, or simply capturing life's moments, journaling offers something valuable for everyone. Journal what you love, what you hate, what's in your head, what's important.

Paddy's Corner

The Oxford English Dictionary defines intuition as the immediate apprehension of an object by the mind without the intervention of any reasoning process.

Paddy's Corner

Hedging, by definition, is a risk management strategy where investors buy or sell assets to reduce the risk of loss.

Paddy's Corner

Gratitude is something I practice every moment and fittingly, my very first LinkedIn post last year was on this very topic.

Paddy's Corner

Emotions play a significant role in investment decisions, just as they do in any business decision. Many experts advise removing emotions from investing, but let's be honestāthat's not entirely possible. Emotion and investing go hand in hand. After all, our emotions often drive us to save and investāwhether it's love for our families, a need for security, or hopes for a better future.

Paddy's Corner

You're well aware of the current situation in theĀ Indian stock marketsāinvestors are understandably worried as their past gains have been wiped out in a matter of days. However, despite this volatility, we must not lose sight of a fundamental truth:Ā market fluctuations are inherent and inevitable.

Paddy's Corner

Let's explore the concept of delayed gratification and why those who master this quality are more likely to succeed

Paddy's Corner

As you navigate your investment journey, you will inevitably face the choice between cash and credit cards. Should you stick to the tried-and-true method of cash, ensuring financial security, or leverage credit to maximize investment opportunities? The key takeaway is that you don't have to choose one over the other. The most important aspect of financial management is understanding both the risks and benefits of each and using them to your advantage.

Paddy's Corner

Some of my friends might josh around, asking, "Come on Paddy, again Budget? You've been preaching about budgets throughout your career."

Paddy's Corner

Aspiration is the driving force that propels us toward our goals. We have aspirations at every stage of our lives, and this post is about my personal journey with aspirations.

Paddy's Corner

We're reaching the end of my current series, and in these 19 weeks, I've shared many long articles. Now, I'd like to capture the essence of these writings with a two-part recap of the key takeaways, to reflect on this journey.

Paddy's Corner

In continuation of last week's analysis of the current popular read The Psychology of Money by Morgan Housel, here are additional key takeaways that provide valuable insights

Paddy's Corner

This week, I'll be discussing a book that's been trending among many of my younger colleagues, especially after it was highly recommended by actor Arvind Swamy in an interview.

Paddy's Corner

For this week, I'd like to discuss a book that's a cornerstone for anyone beginning their self-help journey: Rich Dad Poor Dad. This book, popular since its publication in the late 90s, truly sets a solid foundation for financial understanding. I first read it in the early 2000s, and although I didn't fully grasp its potential back then, upon reflection, I see how insightful and ahead of its time it was. I strongly encourage everyone to give it a read.

Paddy's Corner

To conclude my corporate journey, I am going to discuss two leaders whom I admire the most.

Paddy's Corner

Today I am going to discuss how an entire Team led by a Great Leader had helped an Associate to reclaim life and move forward.

Paddy's Corner

Continuing my Learnings from the Corporate Journey. Today, I want to recount an incident that highlights the importance of grit and timely action from a leader.

Paddy's Corner

Continuing with my learnings from the corporate journey, I want to touch on two important aspects.

Paddy's Corner

A quote that has driven me through various stages of my life is, "Reading is a journey of discovery."

Paddy's Corner

Typically, I start by highlighting the topic before sharing my thoughts, but this time, I decided to switch things up. After all, I believe in practicing what I preach about not succumbing to the quicksand called monotony

Paddy's Corner

Recently, I have seen many posts on my feed about young students successfully qualifying for their final examinations, and their next goal is to secure a position in a good company. In light of these events, I wish to share the journey of my career as well.

Paddy's Corner

These past few weeks, I've shared my investment journey, but my educational background is a crucial part of my life that I want to highlight. "Resilience" is the principle that has guided me through this journey.

Paddy's Corner

My journey is one of continuous learning. Although I have an interest in learning all aspects available, I have come to understand the necessity of aligning my curiosity with my goals. This endeavor has taught me the importance of Focused Curiosity.

Paddy's Corner

Continuing with our theme-based posts, this week I wanted to shed light on a habit emphasized as fundamental in the investment world: āCuriosityā

Paddy's Corner

"The power of compounding". Einstein called it the eighth wonder of the world. The Sage of Omaha, Warren Buffett, practices it. His student, the founder of Pabrai Investment Funds and Dakshana Foundation, Mohnish Pabrai, preaches it.

Paddy's Corner

My journey with this newfound thought began six years ago when I was striving to find my purpose in life. I used every resource available, whether by reading hundreds of books from libraries and stores, starting a Gratitude Journal, practicing affirmations, etc.

Paddy's Corner

Driven by curiosity and a desire to continually learn, Mr. Padmanabhan Raman (Paddy) - CFO - NCS SoftSolutions (P) Ltd, embarked on a journey of knowledge. With the mentorship of Mr. Sanket Pai, he began writing blogs, sharing the wealth of information he acquired through extensive reading. Paddy, will now be sharing his valuable insights through a weekly blog series, starting today. We hope you enjoy these articles and gain meaningful life lessons from them. Happy reading!

Paddy's Corner